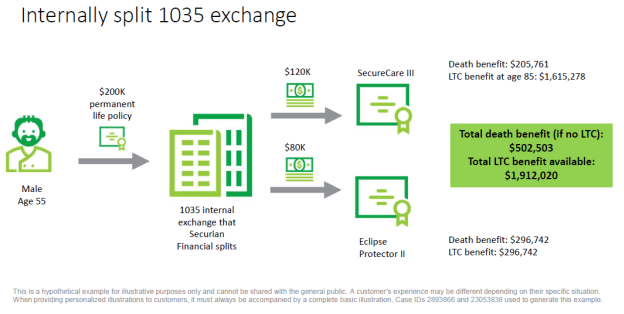

Asset-based LTC sales strategy – a SPLIT 1035 exchange

We wanted to share an Asset-based LTC sales strategy that we are seeing success with amongst advisors, a SPLIT 1035 exchange strategy with Securian.

Let’s say you have a male client age 55 with a $200K old permanent life policy, and he would like to repurpose the policy for Long-Term Care, and maintain some Death Benefit. The client can 1035 exchange that policy with Securian Financial by splitting that $200K into $120K for SecureCare III with a 3% compound inflation option, then take the balance of $80K and pay for an indexed universal life policy, such as Securian’s Eclipse Protector II, with a 4% chronic illness agreement.

This combination sale creates great leverage for Long-Term Care as the client would have over $1.6 million in indemnity LTC benefits by his age 85, and roughly $300,000 in Death Benefit from the Eclipse policy. If the client never uses the SecureCare policy for long-term care, a total combined Death Benefit of over $500,000 would pay out upon death to the beneficiaries between both policies. Here is a breakdown of how this strategy works:

Got questions or need assistance? Give us a call at 631-730-8262 or Click to schedule a 15 minute call